Welcome to Super Simple Budget App. This blog post is the result of many years of passion about personal finance, curiosity about the emotional connection of human to money and my own personal (in)securities about money.

I set out to build an app that helps users track their spending and income with a wide array of reports, all with the goal to create understanding with non-emotional data.

Having founded several tech start ups, my fundamental reason for being is to reduce friction in whatever problem I’m trying to solve. I found that the budget apps available on the Play / App Stores, and web apps, either exfiltrate user data for the benefit of the providers bottom line with no compensation back to the end user, or didn’t have long term stickiness. I got involved with several budgeting apps only to find they didn’t work on new phones or the app just shut down with no warning.

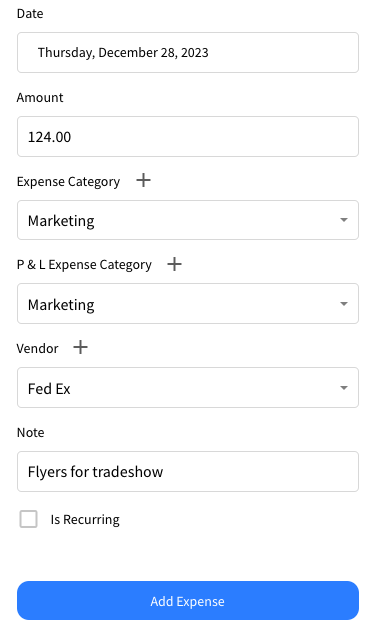

Hence, Super Simple Budget was born. I’ve tried to keep it super simple… Transactions are divided into Expenses or Revenue categories. Those categories can be rolled up / summed into Expense or Revenue P & L categories. For example, if you have multiple Food Expense categories, you can map those to one P & L Expense category for simple reporting. The app also includes a vendor/customer collection so you can track and trendline those dimensions.

Finally, and where we really try and differentiate is on the reporting engine. We’ve built a variety of reports that can be isolated using drop downs and date filters. But at the end of the day, inputting data is simple. The input is mobile first, with large, easy to read fields and buttons.

I hope you enjoy the app and gain insight into your financial life without being a burden to setup, learn and use.